Nebraska State Form Requirements

Form W-2

The State of Nebraska mandates that employers file Form W-2 to report the statement of wages and taxes withheld which includes gross wages, social security and Medicare taxes withheld from the employees. You must file W2 electronically or paper file with the State agency even if there is no state tax withholding.

Current: When the employer has more than 50 W-2 forms to report, W-2 Forms must be filed electronically.

Revised:Employers submitting 50 or more Form W2s to the state, are required to file electronically.

W2 Electronic Filing Requirements:

To File W2 electronically, you should follow the SSA's EFW2 Filing requirements for Form W-2 including the changes to RS (Supplemental Record) & RV record

(State total record).

Click here to learn more about the electronic filing requirements & changes in specifications.

Learn more and Nebraska W-2 Filing.Form 1099

The Nebraska state mandates that you file 1099 electronically or by paper to report the payments made to independent contractors, interest income, dividends & distribution, real estate proceeds, etc received throughout the year.

Nebraska state requires direct state filing of 1099-MISC, R Forms with state tax withholding even though it participates in the CF/SF program.

| Forms | Description |

|---|---|

| Form 1099-NEC | Form 1099-NEC is a variant of Form 1099 used to report payments made to independent contractors. |

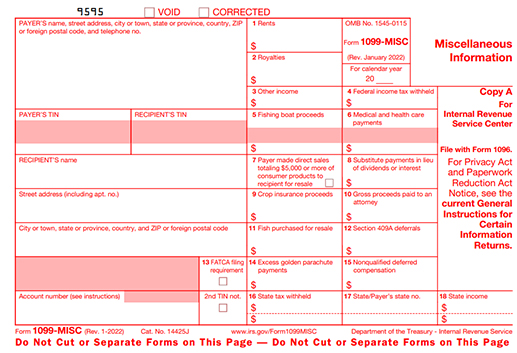

| Form 1099-MISC | Report the total amount of miscellaneous income made during the year for rents, royalties, federal income tax withheld, medical and healthcare payments etc., |

| Form 1099-R |

Report the number of distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., |

1099 Electronic Filing Requirements:

If you choose to file 1099 Forms electronically the state requires you to follow the IRS publication 1220 regarding the changes to Payer and Payee Record.

Visit revenue.nebraska.gov to learn more about the

1099 Filing Requirements.

Form W-3N: Nebraska Reconciliation of Income Tax Withheld

You must file Reconciliation Form W-3N along with the tax forms W2/1099 Forms if there is a state tax withholding. Form W-3N is used to report the total wages/income paid, taxes withheld from all the employees/individuals,and the total balance due.

Deadline to File W2/1099 Forms with the State of Nebraska

Tax Forms W2/1099 must be filed on or before

January 31, 2023

W2/1099 Forms Filing Requirements

for Nebraska State

The following information are required to file the Forms W2/1099 are:

| Employer/Payer Information | Employee/Recipient Information | Payment Details |

|---|---|---|

| Name, EIN/SSN, and Address. | Name, Address, EIN/SSN and Contact Information. | Total Wages, 1099-Payments, Federal & State Taxes Withholdings. |

Nebraskataxfilings.info

Our cloud-based e-filing application provides a simple filing solution at a low price point. Experience the best-in-class features when you file your tax returns with our application. We use advanced security systems to handle your data securely.

Our application offers exclusive features to help you e-file easily, before and during the tax season.

- Built-In Error Checks: Current: You can make sure transmission of error-free forms at the first attempt with the help of our audit check feature.

- Bulk Upload: E-file all your w2/1099s instantly. Upload all your employees/recipients information at once using our Excel templates or your own templates.

- Postal mailing: We print and mail your W2/1099 copies to each employee/recipient on your behalf.

- Print center:After transmitting, access and print the W2/1099 returns at any format from anywhere, at any time.

Revised: Transmit error-free returns with the help of our in-built checks and audits.

Businesses can easily e-file Form 941, 940, 944, 1095-B/C . We have a dedicated US-based support team to guide you throughout the filing process.

Join the millions of businesses e-filing with Federal and State agencies using our application.

How easy is e-filing W2/1099 with Our Application?

To start filing your tax returns, create a FREE account and select the required Form (W-2/1099) you need to e-file.

Follow the below steps to start the e-file process:

- Step 1: Enter Employer/Payer information

- Step 2: Enter Employee/Recipient information

- Step 3: Enter Wages, 1099-Payments, taxes withheld for the federal and the state.

- Step 4: Review, pay and transmit the forms.

You can e-file other tax forms such as 941, 940, 944, 1095-B/C with the same account.

Contact Us

Have any questions about e-filing your tax returns? Reach our experts by phone (704.684.4751), email (support@taxbandits.com), and live chat at your convenience..